The NORM project aims to enhance market risk assessment metrics by using semantically analysed news-based information.NORM is an international collaboration project between SemLab and the Fraunhofer Institute for Financial Mathematics, Optirisk supported by the European union’s Eurostars program. The project aims to enhance market risk assessment metrics by using semantically analysed news-based information. This will compensate for inflexibility of existing models with regard to strong market fluctuations or market instability and give more dynamic, more reliable market risk estimation.

In today’s chaotic financial climate, systems for predicting market behaviour and attitudes of financial professionals are under scrutiny. Current market risk assessment characteristics disregard market information that is available from additional sources like, for example, financial news. There are whole new possibilities for producing meaningful market behaviour models by incorporating behavioural and quantitative finance, using the latest techniques and powerful modelling tools. The prevailing market environment can (to some extent) be captured by key innovative techniques of news analytics that quantify news sentiments.

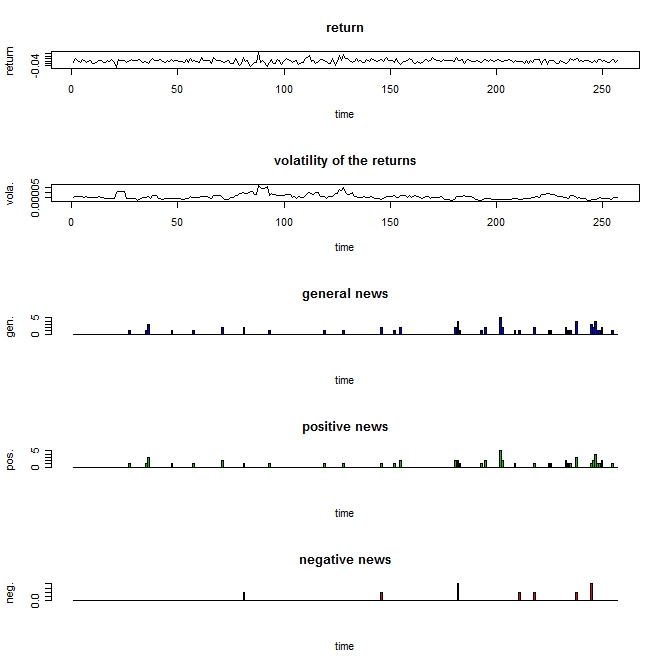

In order to use news as a source for a certain market risk evaluation, it needs to be determined what the impact of news items is on the equities of portfolios in that specific market. Recent technological developments have enabled the creation of data-mining tools that can interpret live news feeds. Combining such technologies with risk metrics could lead to quicker, more flexible and more accurate risk assessment calculations.

In today’s chaotic financial climate, systems for predicting market behaviour and attitudes of financial professionals are under scrutiny. Current market risk assessment characteristics disregard market information that is available from additional sources like, for example, financial news. There are whole new possibilities for producing meaningful market behaviour models by incorporating behavioural and quantitative finance, using the latest techniques and powerful modelling tools. The prevailing market environment can (to some extent) be captured by key innovative techniques of news analytics that quantify news sentiments.

In order to use news as a source for a certain market risk evaluation, it needs to be determined what the impact of news items is on the equities of portfolios in that specific market. Recent technological developments have enabled the creation of data-mining tools that can interpret live news feeds. Combining such technologies with risk metrics could lead to quicker, more flexible and more accurate risk assessment calculations.