Market risk management is very important for the financial market. It is vital to companies and traders to have an appropriate and accurate estimation of the risk of an equity or portfolio losing its value. In the Basel II accord it is even stated specifically that maintenance of regulatory capital is required and calculated for the explicit market of every individual bank. Moreover, Value at Risk (VaR) measures are promoted as the preferred approach to calculating risk.

Recent developments in economic science call for a new approach to market risk measurement, an approach that uses the content of news to give better estimations of the impact and likelihood of market changes and a reliable estimation of the effects of market instability on the value of equities and portfolios. The most important and -until recently- neglected source of information about possible market change and market instability is financial news.

Strategy

The Value at Risk is defined as the maximum negative return (loss) for a given equity, probability and time horizon. For instance if an equity has a one day 95% VaR of 2%, there is a 5% probability that the equity will lose more than 2% of its value over a one day period.

The VaR of a single equity is commonly calculated using one of three methods: by assuming Normally distributed returns, by using a Monte Carlo sampling method or by using he Historical returns over a longer period. The latter method is often preferred but depends on the availability of representative historical data.

The accuracy of the VaR calculation hinges on the question whether the historical data accurately reflects the expected behaviour of the future period. Any method to increase the representativeness of the historical data can therefore be expected to increase the quality of the VaR prediction.

One way to increase the quality of the historical data is to remove any effect that is not expected to occur in the future period. Any market behaviour that results from unique events can be regarded as a “contaminant” of the historical dataset and should be removed.

Unscheduled financial news events, as captured by ViewerPro, can be regarded as unique events that are not representative of the “normal” short to medium term behaviour of an equity. Therefore, the occurrence of an event can be used to clean-up the historical database by removing all resulting volatility.

Result

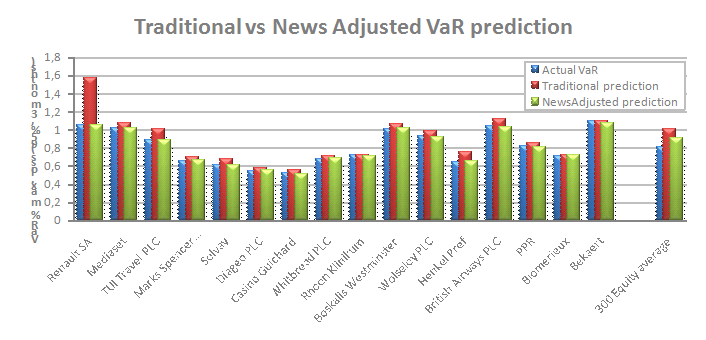

This strategy was tested on a historical dataset of one year’s return data of over 300 equities. ViewerPro was used to detect the common financial events associated with these equities, reported in the popular newswire services. All volatility following the occurrence of an event was removed from the dataset by implementing a simulated trade-hold for 8 hours. The resulting VaR prediction was compared to the traditional VaR calculation using historical data. As a quality benchmark, the actual occurring return distribution was determined.

Using this implementation of news analysis for VaR calculation, an improvement with regard to the traditional Historical method was found in 64% of the equities used. The mean squared error between the predicted VaR and the occurring VaR dropped 22%, from 1.06E-5 to 8.30E-6.

Conclusion

An improvement in accuracy of over 20% was attained for a three month 95% VaR prediction for over 300 equities. This straightforward implementation illustrates the potential benefits of using financial news analysis to improve market risk assessment.

If you have any questions about this section or about using ViewerPro semantic processing and data extraction in general , please contact us for a free demo of our software.