With Semlab’ proprietary semantic web software you can analyze millions of user forums, tumblr blogs, Twitter, Facebook and Google+ feeds, in order to measure in real-time the sentiment of your product and service opinions.

It has been a challenge imposed by processing social media because of use of incorrect language, irony, short or incomplete sentences, lack of contextual information, use of multiple languages and use of slang but Semlab succeeded to address all of these challenges with its semantic web solutions and other language processing technologies.

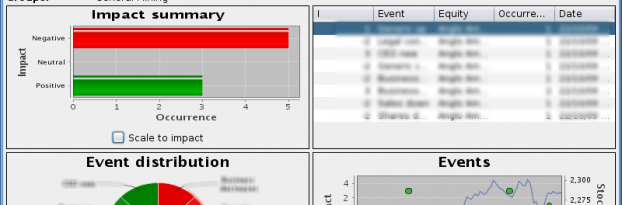

Semlab successfully can offer with the highest precision- and recall, of what the people think about your product and service.Don’t matter what language, slang they are using, you will capture the sentiment of the crowd immediately .User Case: Financial ServiceIn the domain of retail financial services, e.g. stock market investments, insurances, mortgages and consumer saving- & lending money, product- and service offering opinions will be processed real time.The combination of machine translation and automatic sentiment analysis has proven to be effective as semantic sentiment analysis appear to be relatively insensitive to grammatical translation errors. Especially in verbose and plentiful (highly redundant) social media messages even imperfect translations allow for reliable sentiment extraction. This was demonstrated in a precious project SemLab executed with the world most respected universities in this field where 81% translation accuracy was sufficient to drive adequate sentiment extraction from financial big data in social mediaThe resulting sentiment will be visualised in a GUI suitable for monitoring social media and to enable integration in social media outings.

The solution will be accessible through a web based service providing a clear visualization of the sentiment data and database.

The reputation brand monitoring and marketing solution is specially suitable for retail banks and insurance companies. These companies valued the content coming from the solution as consumer feed back of the findings of their financial products and how new financial product are received in the market.

This solution will address specifically the risk metric of financial service products from the eyes of consumers, the feed-back will allow the financial service companies to adjust the offerings accordingly and consequently improve reputation in the market.

A clear example of the current situation is the recent development on the Dutch mortgage market. The Dutch government has declared that the requirements for a mortgage are seriously increased. However to prevent total lock-up of the property market, the public is allowed to take a second loan. This second loan can be used to fulfil mortgage payments. Whereas this leads to opportunities for the mortgage suppliers, the general public is unable to assess the implications this can have for their overall cost. This is currently causing severe unrest in the Dutch mortgage market indicating the severely increased sensitivity of the financial services market for this – relatively transparent – measure.

Another example is the panic fuels Latvian run on Swedbank

http://www.bbc.co.uk/news/business-16142000

If you want to stay in control of the opinion: use our proprietary semantic web software.