In a speech in Amsterdam on Thursday, the ECB president Mario Draghi said he is convinced that publishing an account of the main arguments raised in the central bank’s monthly policy meetings “would be useful” and “will on balance serve to strengthen the governing council’s collegiate decision making and communication”.

Bram Stalknecht, CEO SemLab said publishing non-attributed minutes of council meetings will open up the ECB’s decision making process, as an addition to ECB the monthly held press conferences, avoiding unexpected decisions.

With SemLab council meetings sentiment analytics, customers can react faster on ECB decisions, including conventional measures, eg liquidity operations and longer-term fixed rate operations. This provides at-a-glance insight in macro economic moving events, in a computer readable format.The resulting minute events are ranked according to their implicit sentiment on scale of -5 (negative) to 5 (positive).

Mario Draghi has backed plans for the European Central Bank to publish non-attributed minutes of its governing council meetings, a proposal that would move the central bank closer to its peers in the UK, US and Japan.

All posts tagged ViewerPro

April 29, 2014

SemLab news analytics now available with event sentiment from non-attributed minutes of ECB governing council meetings

May 13, 2013

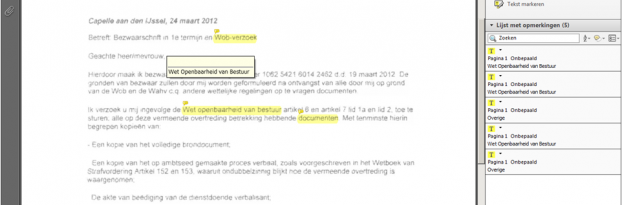

ViewerPro automatiseert verwerking Wet Openbaarheid van Bestuur (WOB) verzoeken

SemLab’s VIEWERPRO software wordt ingezet tegen het explosief stijgende aantal verzoeken van burgers, bedrijven en advocaten die beroep doen op de Wet openbaarheid van bestuur (WOB). “De reactietijd is thans zo verbeterd dat onze klanten, waaronder het Openbaar Ministerie, de stroom WOB verzoeken makkelijk aankunnen, en ruimschoots binnen de wettelijk gestelde termijn kunnen reageren” zegt Bram Stalknecht, SEMLAB te Alphen aan den Rijn. “Onze klanten vermoeden steeds vaker misbruik van deze wet, en hebben de stap genomen om onze taaltechnologie te gebruiken voor het detecteren van deze verzoeken. Door onze technologie in het informatieproces te integreren wordt de informatiestroom door een intelligent computersysteem gestuurd. Medewerkers worden nu ontlast en het systeem is zo ingeregeld dat het pieken makkelijk kan opvangen en flexibel voor elk WOB-onderwerp kan worden ingericht.”

Door middel van Natural Language Processing en Artificial Intelligence technieken detecteert VIEWERPRO met hoogste precisie en recall woorden en begrippen die relevant zijn uit de binnenkomende brieven en e-mails. Deze worden automatisch opgenomen in de reacties naar de verzoekers.

May 13, 2013

SemLab Internship Opportunities: Now open for international candidates

Internship Opportunities: Now open for international candidates:

1- Econometrics & Operations Research

2- Quantitative Modeling for Algorithmic Trading & Testing

We are looking for candidates for our fast growing work in our knowledge engineering developments in algorithmic trading.

Ad1-

Background of candidate is in Econometrics & Operations Research at a M.A. level university.

The candidate will be joining our Research & Development team in The Netherlands, near Amsterdam Airport. The thesis project is focusing on news analytics for multi asset class investments. The candidates should have an understanding of the implications and effects from news events on investments and risks. Macro economics and fixed income as well as equities and derivatives are subjects of interest of the internship work.

Duration: 6 month. After a successful completion of the thesis it is expected to be part of the growing development team.

Ad2-

Background of the candidate is in Quantitative Modeling and/or Financial Mathematics (M.Sc./PhD-thesis)

The candidate will be joining our Research & Development team in The Netherlands, near Amsterdam Airport. The thesis project is focusing on news analytics and market data for equity asset class algorithmic trading.

Candidates should have an understanding of risk/(multi) asset valuation modeling and an emphasis on financial service applications.

We require academic experience in the field of financial data analysis and research, with strong analytic solving skills, including tools like Matlab/R and experience of working with statistics and data sets for testing your algorithm and benchmark against indices.

Communication in English is essential to both of the intern positions as well as a valid EU working permit.

If you are interested in any of these positions please send your C.V. to stalknecht@semlab.nl

April 12, 2013

SemLab Sponsor of NYU-Poly’s Big Data Finance Conference, May 3, NYC

SEMLAB is sponsoring the Big Data Finance Workshop organized by the department of Finance and Risk Engineering of New York University, Polytechnic Institute on May 3, 2013, New York City

The target audience (invitation only) includes top academics in the field and practitioners in the high-frequency, quantitative and algorithmic industries, including customers like Goldman Sachs, ITG, QuantRisk Trading, Credit Suisse, JP MorganChase.

During the workshop SEMLAB will discuss advanced semantic analytics, specifically for quantitative- and algorithmic financial big data processing.

For more information: big data finance conference

October 5, 2012

Funds trading on sentiment. Does it work?

A recent survey (posted on Battle of the Quants, London, Sept. 10) indicated that 30% of USA hedge funds are employing some type of sentiment analysis in their trading models. Many multi-factor based quantitative hedge funds are adding a sentiment factor to reflect how markets are reacting more often to headlines, fear and greed vs. fundamentals. Other trading strategies are going further and relying purely on sentiment to trade the markets. SemLab News Analytics Solution VIEWERPRO providing sentiment output for many trading models and markets.

To investigate the alpha generation for your trading activities, we are offering evaluation projects. Please contact sales at semlab d ot nl and find out how best to leverage sentiment to drive returns

December 2, 2011

News Sentiment HD App for iPad launched in iTunes Store

The News Sentiment HD App analyses current financial news in real time and displays the news sentiment of all major equities in an intuitive graphical interface. This provides at-a-glance insight in market moving events and keeps you ahead of the competition.

SemLab’s News Sentiment HD optimizes the way you keep in touch with the rapid developments in global equity markets by:

✩ Aggregating over 57 leading news sources.

✩ Analyzing the news impact for all major equities.

✩ Visualizing for immediate insight into potentially market moving developments.

NewsSentiment HD is used by professional and private fund managers to stay abreast of current affairs and ahead of the competition.

✩ Act before the market moves.

✩ Boost your 401k and equity portfolio return.

✩ Be well informed and act quicker than the exchange.

NewsSentiment HD for iPad is the ultimate app to boost your 401k and equity portfolio return. It empowers you to keep ahead of the US/EU equity markets and abreast of relevant news events – always.

Features:

✩ Enhanced for iPad

✩ Detailed news events

✩ Global market overview

✩ Real-time, 24×7, minimal latency

✩ Intuitive interface, no training required

✩ Aggregated news from over 57 news sources

For more information, please visit the iTunes Store.

October 6, 2011

Join a live Twitterview from @DJSalesTrading on sentiment analysis!

SemLab’s Bram Stalknecht and Rob Passarella of Dow Jones Newswires will host a Twitterview discussion on Sentiment Analysis in Trading on October 13, 2011.

Find out why sentiment analysis is having a major impact in today’s institutional trading markets and what it can do to give you a competitive advantage. Our experts will discuss topics such as: What is sentiment analysis? How can traders use news sentiment analysis? How are subjectivity and the intensity of words dealt with? How does the industry profit by sentiment analysis? What competitive edge can traders and quants get from sentiment analysis? What’s the future of trading on sentiment?

PANELISTS:

Rob Passarella, Vice President of Institutional Markets and Managing Director, Dow Jones Newswires

@robpas

Bram Stalknecht, CEO of SemLab, whose focus is on information technology-driven markets with extreme data processing and data-management needs

@semlabtweets

WHEN: October 13, 10:00-10:30 am ET / 3:00-3:30 pm GMT

WHERE: Follow the Twitterview on #djsemchat

June 14, 2011

MASS Proposal passes first FP7 stage

SemLab has passed the first stage with their MASS proposal for the FP7 call on Digital Content and Languages, a funding scheme of the European Commission.

In this proposal, SemLab and innovative European partner organisations propose to create a functioning multimedia sentiment analysis platform that incorporates automatic semantic analysis of customer feedback from a wide variety of web-based multimedia, and automatic translation of small and large European languages.

In order to understand social customers, companies must understand the (often unknown) languages of their customers. Today’s existing social CRM solutions are monolingual and are not suitable for following consumers’ responses across Europe. By incorporating automatic translation for larger and smaller European languages into the system, MASS can step beyond the current state of the art and deliver a database of social media information and a system that can determine sentiment from different language groups, cultures, and countries from these data.

This will enable companies to tap into a large base of social customer sentiment, and use this in their CRM solutions. By using the latest semantic analysis technologies, the sentiment portrayed in social media can be extracted. Furthermore, smart semantic tools are used to interpret specific web language, such as shortened words or expressions, emoticons, new ‘internet’ language, etc.

April 22, 2011

Deutsche Börse announces ‘ AlphaFlash Corporate News Germany’

Deutsche Börse has issued a press release stating that their algo news feed AlphaFlash will now deliver unscheduled corporate financial data in machine-readable format. This is the first step in an expanding service. Additional news types and countries will be added later.

AlphaFlash is supported by SemLab’s semantic analysis technology.

To read the press release, follow this link: Deutsche Börse Media Announcements

January 11, 2011

Automated News Analysis on Wall Street

The New York Times recently published an article about the automated news anaylsis tools that are currently being used on Wall Street. The article describes the current trend – and potential – of using semantic analysis tools for analysing news, such as the news information published in news reports, blogs and Twitter feeds.

The technologies described are very similar to SemLab’s ViewerPro technology for automatic semantic analysis of news.

You can find the original article here: NY Times website

Read more

Read more