The Solim project for spatial reasoning has entered the last phase, in which the technology developed will be implemented into two POC applications for evaluation. The two applications that will utilise the spatial reasoning technology are Picsearch’s Image Searching system and Tilde’s Machine Translation system.

our News

August 20, 2010

SOLIM project in last phase

August 16, 2010

Active summer for SemLab

Even though summertime is usually a calm time for technology companies, SemLab has been very active in several commercial projects. We have been installing, testing and running our ViewerPro software at several large financial institutions and organisations in various countries. In addition, we are involved in several international research projects.

May 25, 2010

NORM – News Optimised Risk Management project started

The NORM project has now officially started. NORM, short for News Optimised Risk management, is a project commissioned by the European Union to research the effects of financial news on market risk predictions. In order to study this, the project will use SemLab’s ViewerPro system for automated semantic news analysis, together with state of the art risk modelling techniques.

May 25, 2010

VACATURE: Java developer

SemLab is een groeiend kennisintensief en innovatief softwarebedrijf met hoogopgeleide medewerkers.

SemLab heeft een internationale klantenkring, die bestaat uit de grootste financiële services organisaties in Europa. Ook klanten in Nederland worden bediend met beslissingsondersteunende applicaties waarbij het er om draait de beschikbare informatie juist te interpreteren en snel de juiste actie te ondernemen.

Of het nu gaat om patiëntenzorg of de handel in derivaten, SemLab’s nieuwste software applicaties ondersteunen de professional met de juiste informatie om snel tot het optimale resultaat te komen.

SemLab maakt nu een grote groei door en zoekt per direct:

JAVA DEVELOPER

SemLab zoekt een enthousiaste, leergierige Java developer met 2-5 jaar ervaring bij een software bedrijf.

Ruime ervaring met Java (SCJP of vergelijkbaar) en Swing is vereist.

Affiniteit met taaltechnologie, beslissingsondersteuning en/of aantoonbare (SCJD) kennis van de volgende technologie strekt tot aanbeveling :

• Webservices

• J2EE

• Sesame (Open RDF)

• Maven

• parallel programming (multi threaded)

We bieden een interessante functie met doorgroeimogelijkheden, een marktconform salaris en leuke collega’s.

Reageren?

Mail naar info@semlab.nl of bel naar 0172 494 777 en vraag naar Dr. Mark Vreijling.

Acquisitie op deze functie wordt niet op prijs gesteld.

May 22, 2010

SemLab starts several International Projects in Financial News Analysis

In the coming months Semlab’s ViewerPro system for automated semantic analysis of financial news, will be used by several international financial organisations in Japan, the USA, France, Germany, the U.K and the Netherlands.

ViewerPro processes incoming financial news events and determined the impact of messages on equity portfolios.

February 18, 2010

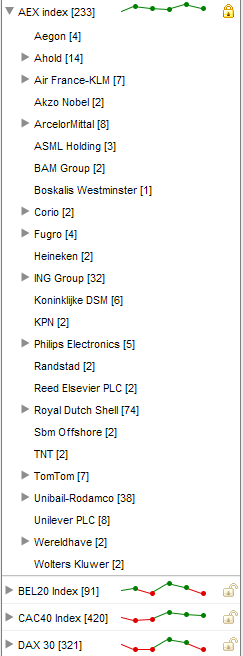

ViewerPro now covers multiple European stock exchanges

ViewerPro was already connected to news sources such as Thomson Reuters, Dow Jones and various RSS feeds, and has now expanded by covering multiple European stock exchanges.

ViewerPro now incorporates the FTSE AllShare index (London), the AEX (Amsterdam), BEL20 (Brussels), DAX30 (Frankfurt) and the CAC40 (Paris), thereby automatically identifying news events for companies within the UK, the Netherlands, Belgium, Germany and France.

In the nearby future, we will expand further to for example south European stock exchanges.

January 28, 2010

ViewerPro Client evaluation CD ready for launch

The finalised copies of the ViewerPro Client evaluation CD are ready to be handed out at the next few meetings that Semlab will attend.

This promotional CD contains a fully functional trial version of the ViewerPro client for financial news analysis, intended for evaluation purposes. This trial includes access to the live DowJones Newswire feed and includes installers for Microsoft Windows and Linux platforms.

January 20, 2010

Semlab lecture at Carisma Workshop

Semlab’s Mark Vreijling will lecture at the pre-conference workshop of News Analytics Applied to Trading, Fund Management and Risk Control, at the 1st of February 2010, London.

The lecture, titled Practical Use of News in Equity Trading Strategies will address issues concerning the possibilities of current technologies to quantify the content of news, how news analytics are to be used and the benefits of automatic news analytics for equity trading strategies.

For more information: Carisma Workshop

January 20, 2010

Semlab to research News Optimised Risk Management (NORM)

The European Union has approved our NORM proposal. Semlab and a consortium of international partners will start researching News Optimised Risk Management.

In today’s chaotic financial climate, systems for predicting market behaviour and attitudes of financial professionals are under scrutiny. Current market risk assessment characteristics disregard market information that is available from additional sources like, for example, financial news. There are whole new possibilities for producing meaningful market behaviour models by incorporating behavioural and quantitative finance, using the latest techniques and powerful modelling tools. The prevailing market environment can (to some extent) be captured by key innovative techniques of news analytics that quantify news sentiments. The emergence and impact of such behavioural finance is illustrated by the 4-5 Nobel Prizes for Economics awarded in this field in recent years.

This project aims to enhance market risk assessment metrics by using semantically analysed news-based information. This will compensate for inflexibility of existing models with regard to strong market fluctuations or market instability and give more dynamic, more reliable market risk estimation.

November 11, 2009

Forum on News Analytics, London

This week, Semlab attended the ‘Forum on News Analytics applied to Trading, Fund Management and Risk Control’, at Canary Wharf in London.

Our director of research, Dr. Mark Vreijling, gave a lecture on Semlab’s cutting edge news analytics platform ViewerPro, and the prospects of using semantic news analysis for Trading and Risk Control.

Financial news contains market information that is potentially useful for trading and risk assessment. Most financial companies still have no way of automatically analysing news and information is either missed or takes long to process. With semantic analysis platforms like ViewerPro, no news is missed and desisions can be made much quicker.

For more information: Forum on News Analytics

Read more

Read more