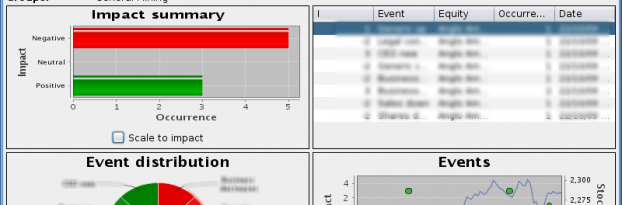

SemLab’s semantic text processing platform enables the real-time monitoring of product and brand associated sentiments. In our showcase application AutoSentiment we continuously monitor the top ten most popular online automotive blog websites in The Netherlands and capture the sentiments expressed in the edited articles as well as in the readers’ comments.

In contrast to traditional sentiment tools, we determine the semantics of the expressed opinions by comparing the text to an automotive ontology of over 300 events. These events describe the most common concepts expressed in these types of text. For example the events range from “I like the car” to “the engine noise is barely audible”. Furthermore, the events are classified in the seven main quality parameters for luxury cars: Price, Looks, Driving experience, Comfort, Fuel consumption, Quality and Safety.

A live version of the AutoSentiment monitoring system is available here.

Results

The system is currently online and has processed about 145.000 text items resulting in 141.396 useful events. Excluding all car brands that yield 50 events or less, results in data on the 37 most popular car brands currently available in The Netherlands.

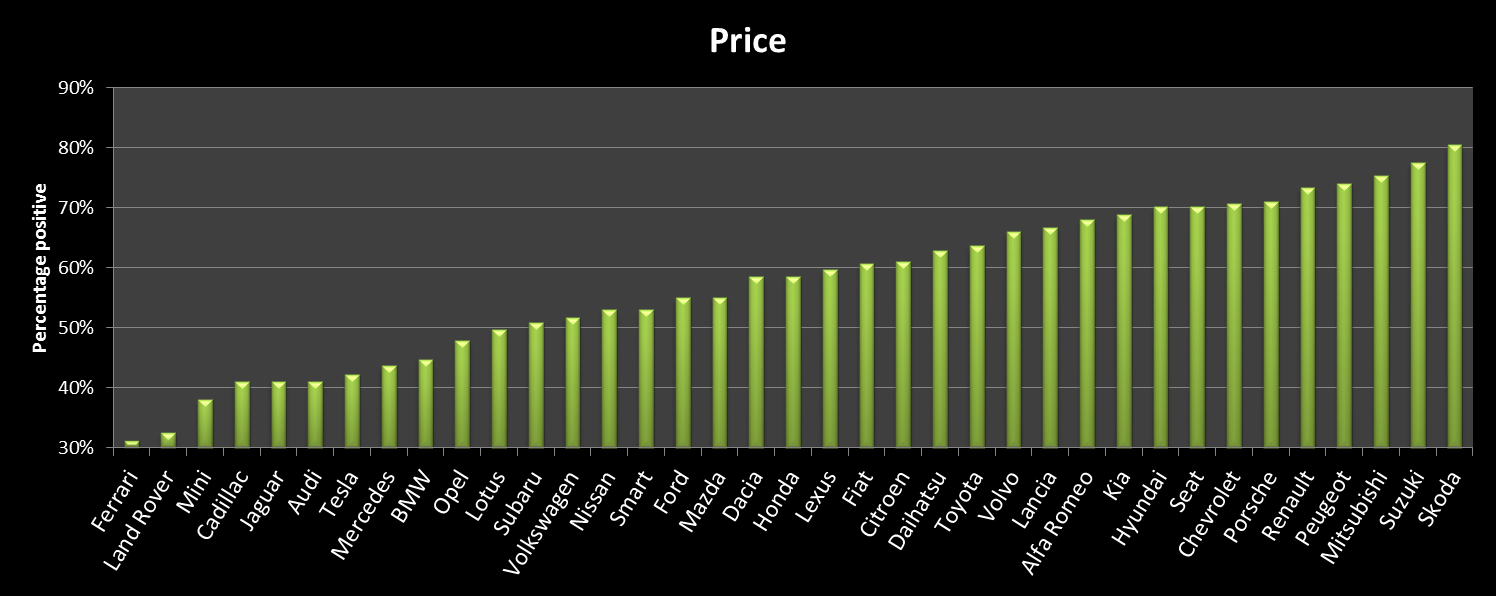

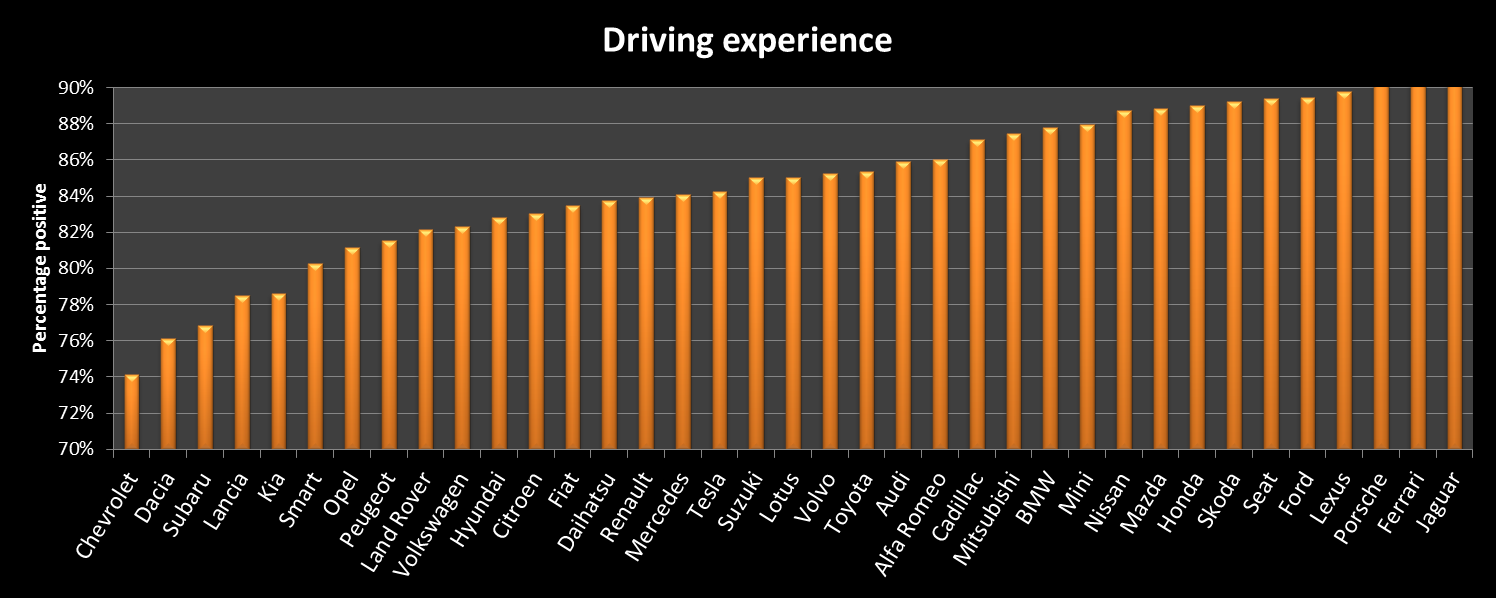

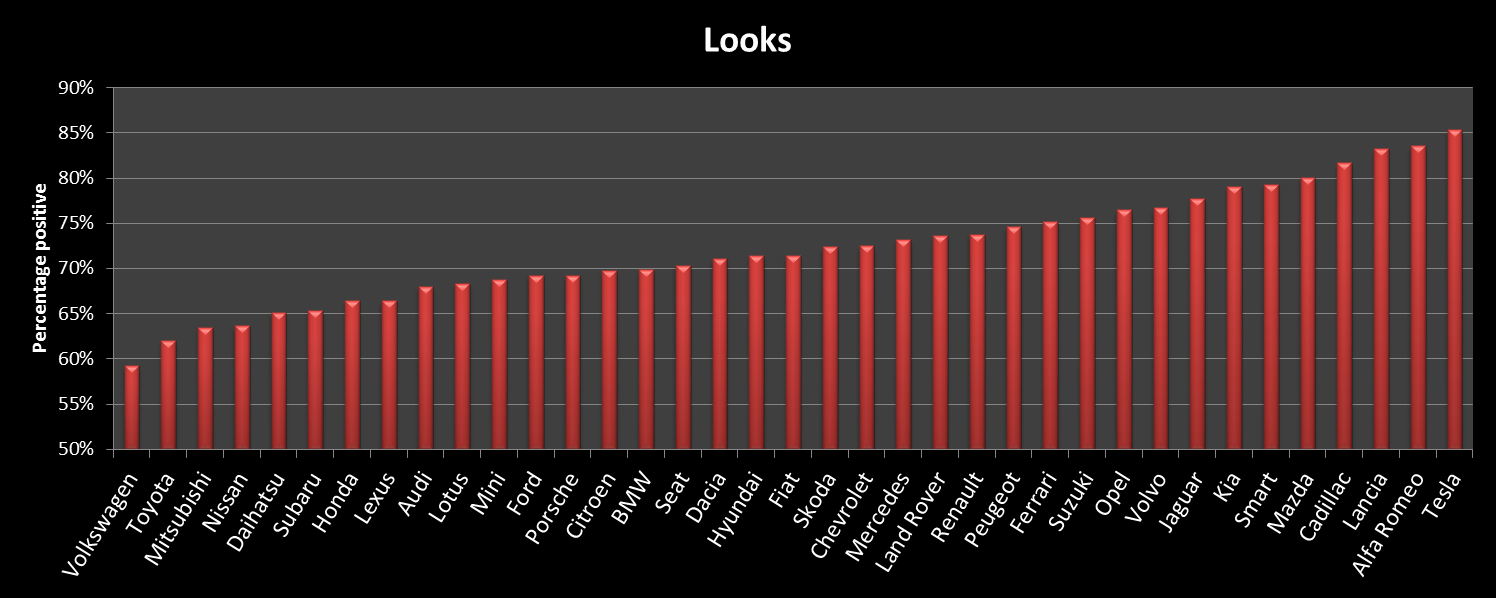

Ranking this data according to the defined parameters results in the following graphs:

The graph above lists the car brands according to the percentage of positive sentiment about its purchasing cost. On the left hand side the brands are perceived as (too) expensive, the cars on the right are deemed affordable or to offer good value for money.

The overall results are not surprising: The top five expensive car brands include Ferrari, Land Rover and Cadillac, whereas the affordable brands are Skoda, Suzuki and Mitsubishi. More interesting is the position of Dacia and Renault. Renault is perceived as significantly more affordable than its low cost sister brand Dacia, which this data puts in the same range as the acclaimed luxury brand Lexus.

Regarding the driving experience, the top three consists of Porsche, Jaguar and Ferrari. The worst driving experience is expected from Chevrolet (In The Netherlands mostly marketing the former Daewoo models) and Dacia.

The aesthetics associated with the car brands result in the graph above. The bottom section is the domain of most of the Japanese brands (with the exception of Suzuki and Mazda) and, more surprisingly Volkswagen. The top section is populated by the Italian design of Alfa Romeo and Lancia, but also Tesla whose limited model range has an almost unanimous appeal.

Value for money

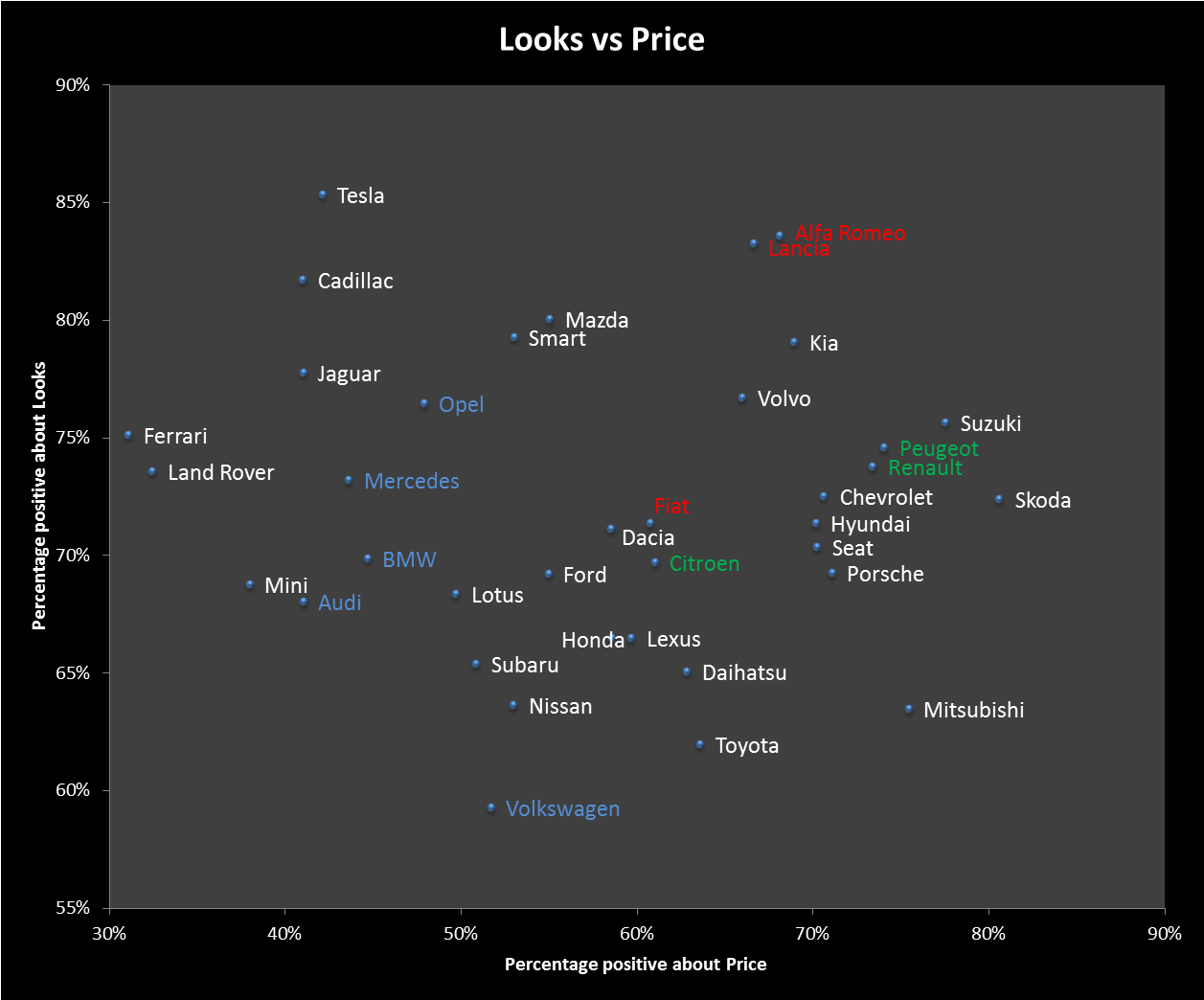

Another way of examining this data is to plot one factor against the other. For instance when using price on the horizontal axis and the looks on the vertical axis results in the graph below.

This graph clearly illustrates that for affordable good looking cast the Italian brands are in a league of their own. Fiat seems to be a bit out of contact with the other Italian brands, but still scores higher than most traditionally German brands.

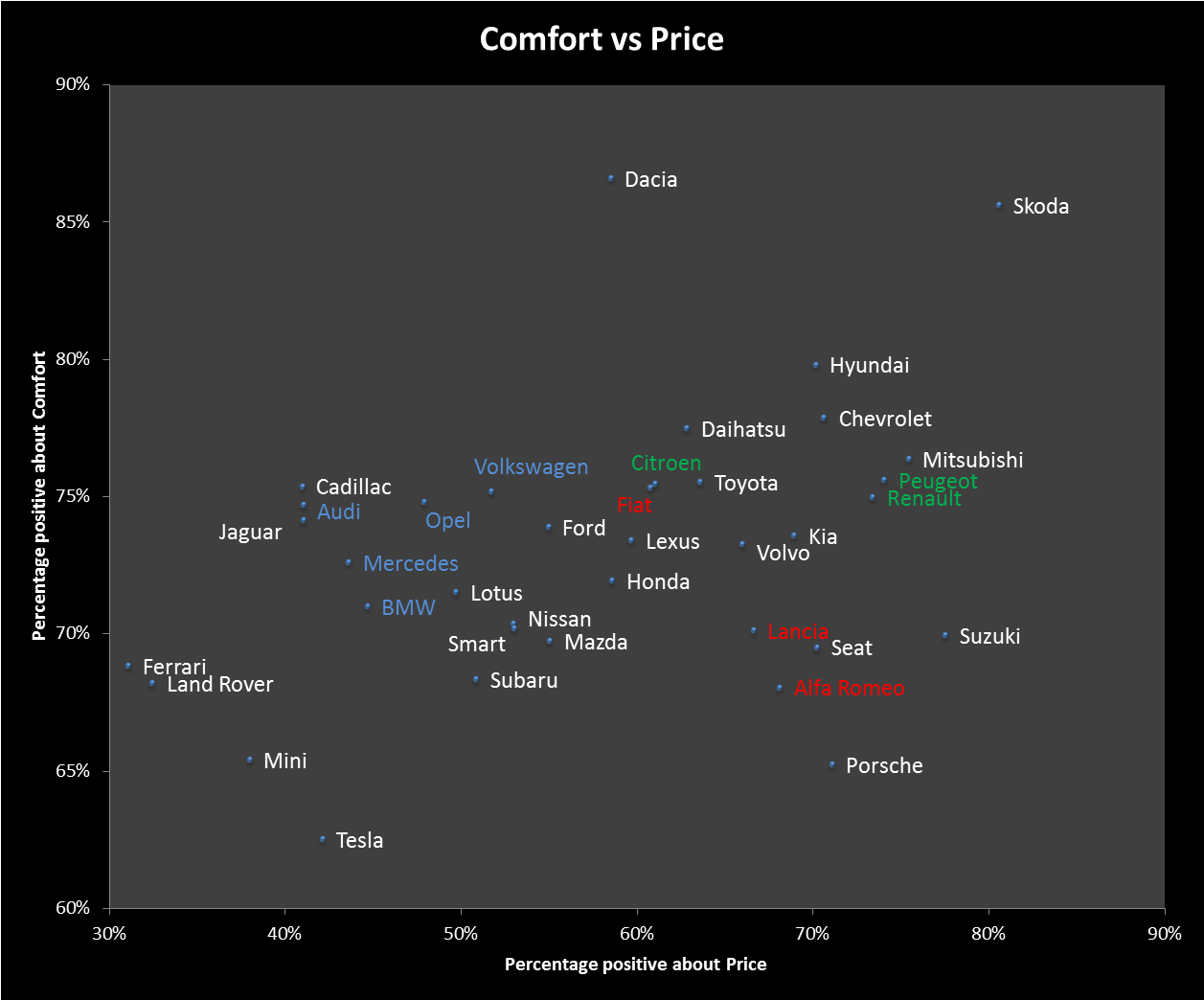

The French brands are mostly associated with reasonably affordable and generally comfortable cars. This expectation can also be checked using our data since comfort was one of the main parameters included. The graph below plots the perceived comfort versus the price level of that brand.

The graph above illustrates that the Italian brands are perceived to offer less comfortable cars that the traditionally French brands. German brands score similarly but are generally in a higher price range. Surprisingly, Volkswagen scores higher than the luxury brands Mercedes and BMW. This may well result from the definition of Comfort used in this test, which included ergonomics, personal space and general practicality.

Conclusion

The conclusion that we draw from these results is that the data appears to be in agreement with most stereotypical preconceptions about the car brands. This is a good thing since the system is aimed at capturing the opinion of the general public, which by its nature can be expected to be sensitive to stereotyping.

A logical improvement in this study is to examine the various car models instead of the generic brands. In fact, the required data is available so if anyone is interested in these results or any other aspect of real time product sentiment monitoring, please don’t hesitate to contact us.

Read more

Read more