Legal Robot™: De eerste Nederlandse Intelligente jurisprudentiemachine wordt in oktober verwacht als Bèta op www.semlab.nl/legalrobot. De webapplicatie maakt gebruik van Artificiële Intelligentie (AI) en zal kosteloos worden aangeboden aan juristen en advocaten.

De applicatie bevat alle publieke jurisprudentie voor strafrecht en gerelateerde rechtsgebieden. Overige rechtsgebieden worden in het loop van dit jaar toegevoegd.

De AI van LegalRobot™ heeft de documenten geanalyseerd waardoor U:

• kan filteren op het gebruikte verweer of daderschap kenmerken.

• kan zoeken in specifieke secties van het document.

• kan filteren op rechter of advocaat.

• kan selecteren op vrijspraken of juist veroordelingen.

Hiermee wordt het mogelijk om in te schatten welke advocaat bij welke rechter voor welk soort delict de meeste kans maakt op een vrijspraak.

Legal Robot™ is als merk gedeponeerd in de Benelux door SemLab BV .

.

All posts in Domains

September 22, 2016

Wie is de beste advocaat of de strengste rechter van Nederland?

April 29, 2014

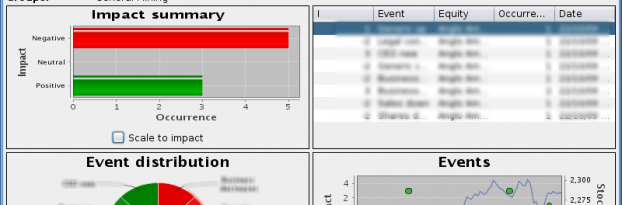

SemLab news analytics now available with event sentiment from non-attributed minutes of ECB governing council meetings

In a speech in Amsterdam on Thursday, the ECB president Mario Draghi said he is convinced that publishing an account of the main arguments raised in the central bank’s monthly policy meetings “would be useful” and “will on balance serve to strengthen the governing council’s collegiate decision making and communication”.

Bram Stalknecht, CEO SemLab said publishing non-attributed minutes of council meetings will open up the ECB’s decision making process, as an addition to ECB the monthly held press conferences, avoiding unexpected decisions.

With SemLab council meetings sentiment analytics, customers can react faster on ECB decisions, including conventional measures, eg liquidity operations and longer-term fixed rate operations. This provides at-a-glance insight in macro economic moving events, in a computer readable format.The resulting minute events are ranked according to their implicit sentiment on scale of -5 (negative) to 5 (positive).

Mario Draghi has backed plans for the European Central Bank to publish non-attributed minutes of its governing council meetings, a proposal that would move the central bank closer to its peers in the UK, US and Japan.

July 3, 2013

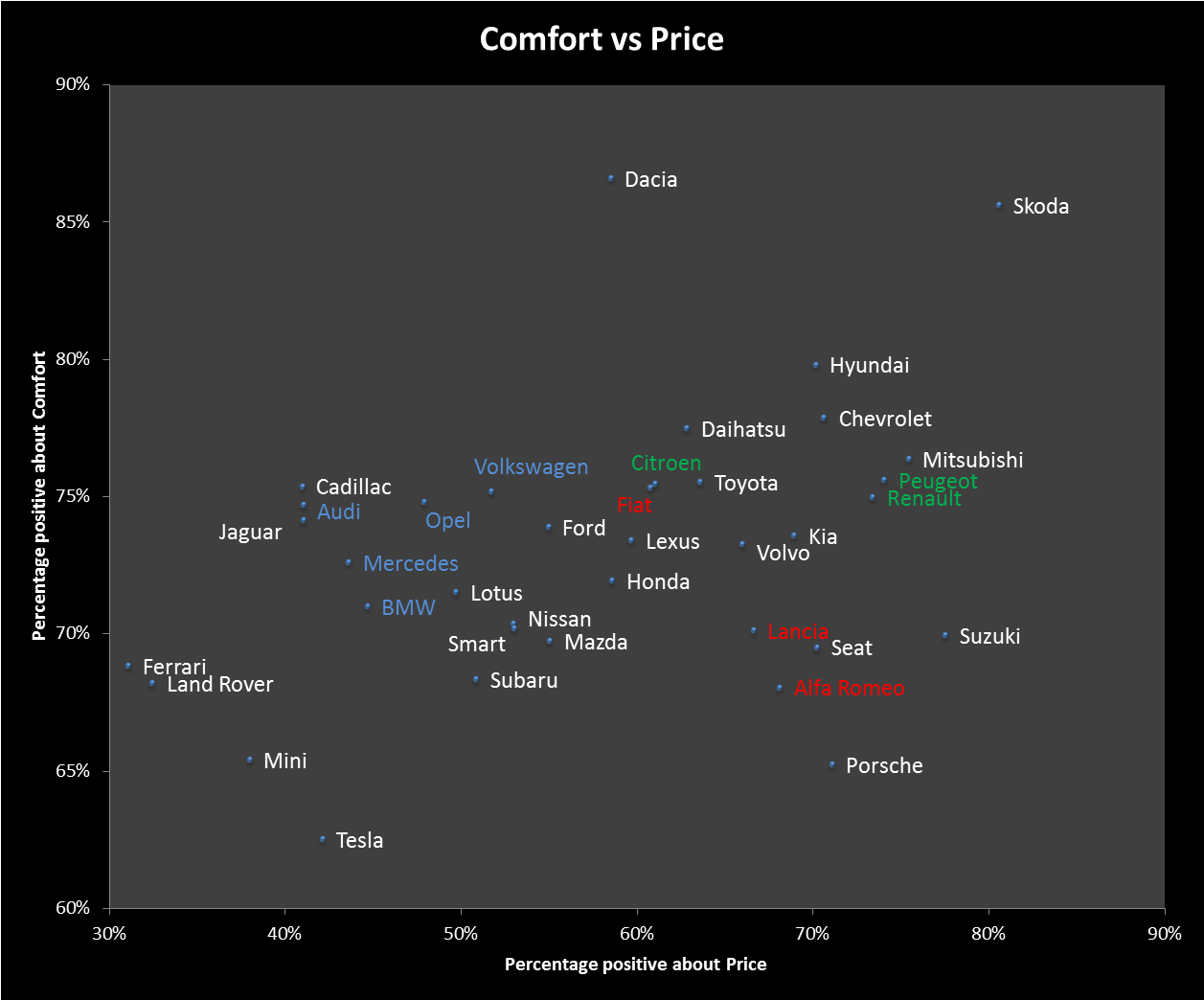

Ranking Luxury cars brands based on sentiment

SemLab’s semantic text processing platform enables the real-time monitoring of product and brand associated sentiments. In our showcase application AutoSentiment we continuously monitor the top ten most popular online automotive blog websites in The Netherlands and capture the sentiments expressed in the edited articles as well as in the readers’ comments.

In contrast to traditional sentiment tools, we determine the semantics of the expressed opinions by comparing the text to an automotive ontology of over 300 events. These events describe the most common concepts expressed in these types of text. For example the events range from “I like the car” to “the engine noise is barely audible”. Furthermore, the events are classified in the seven main quality parameters for luxury cars: Price, Looks, Driving experience, Comfort, Fuel consumption, Quality and Safety.

A live version of the AutoSentiment monitoring system is available here.

Results

The system is currently online and has processed about 145.000 text items resulting in 141.396 useful events. Excluding all car brands that yield 50 events or less, results in data on the 37 most popular car brands currently available in The Netherlands.

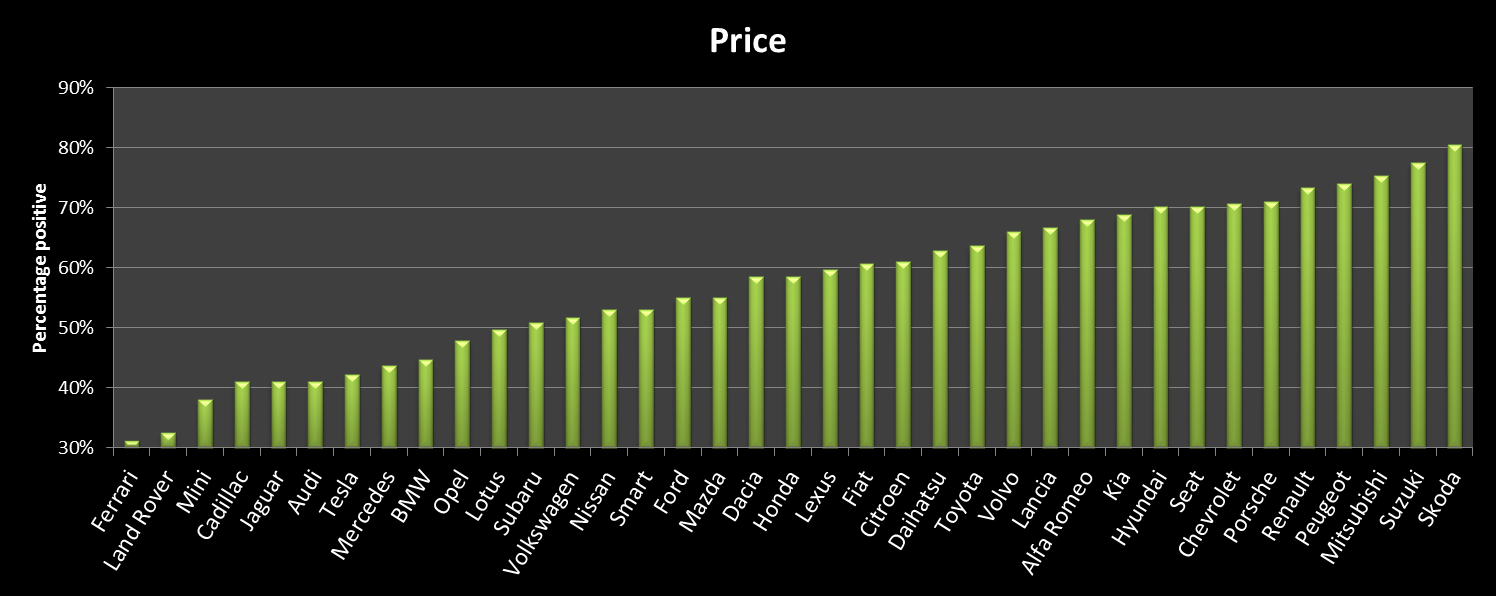

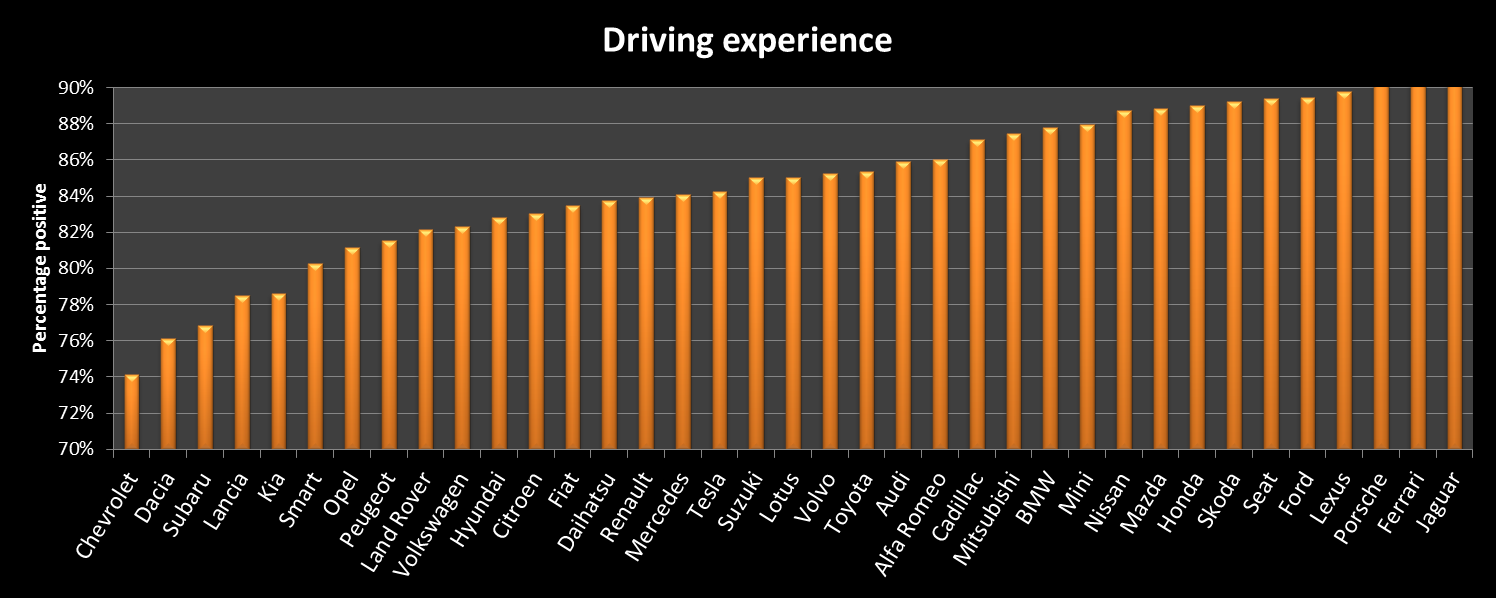

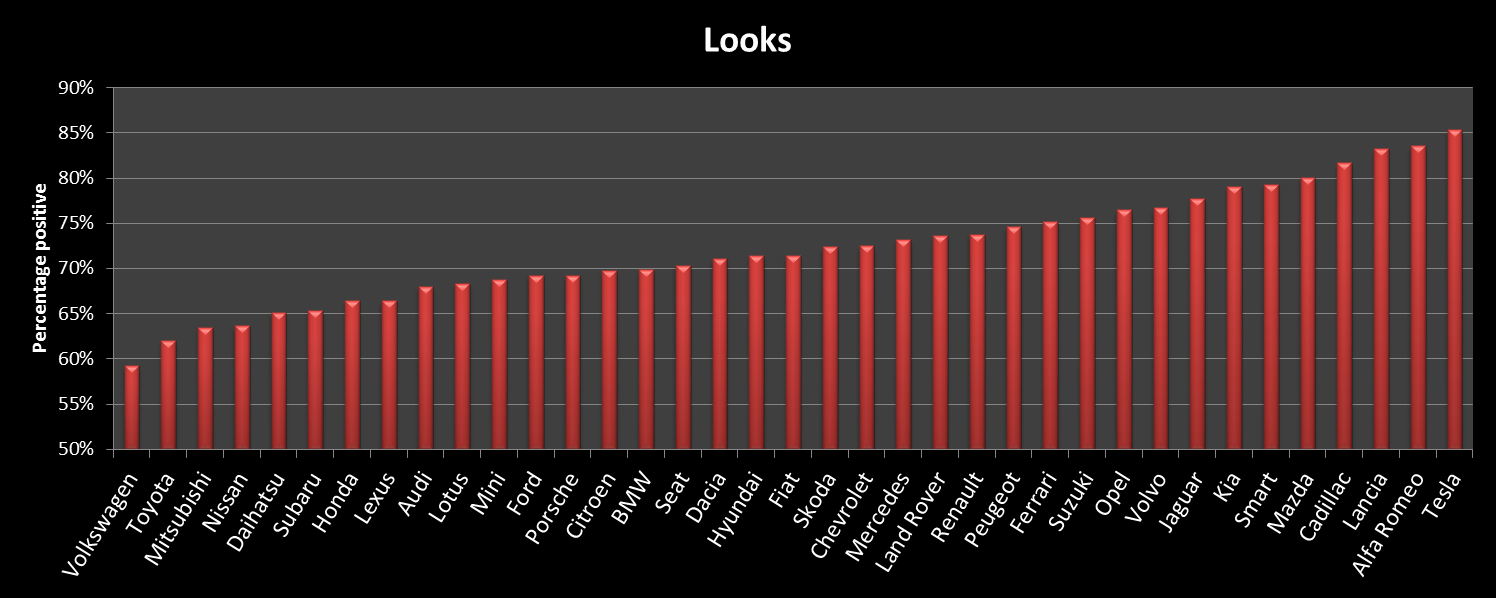

Ranking this data according to the defined parameters results in the following graphs:

The graph above lists the car brands according to the percentage of positive sentiment about its purchasing cost. On the left hand side the brands are perceived as (too) expensive, the cars on the right are deemed affordable or to offer good value for money.

The overall results are not surprising: The top five expensive car brands include Ferrari, Land Rover and Cadillac, whereas the affordable brands are Skoda, Suzuki and Mitsubishi. More interesting is the position of Dacia and Renault. Renault is perceived as significantly more affordable than its low cost sister brand Dacia, which this data puts in the same range as the acclaimed luxury brand Lexus.

Regarding the driving experience, the top three consists of Porsche, Jaguar and Ferrari. The worst driving experience is expected from Chevrolet (In The Netherlands mostly marketing the former Daewoo models) and Dacia.

The aesthetics associated with the car brands result in the graph above. The bottom section is the domain of most of the Japanese brands (with the exception of Suzuki and Mazda) and, more surprisingly Volkswagen. The top section is populated by the Italian design of Alfa Romeo and Lancia, but also Tesla whose limited model range has an almost unanimous appeal.

Value for money

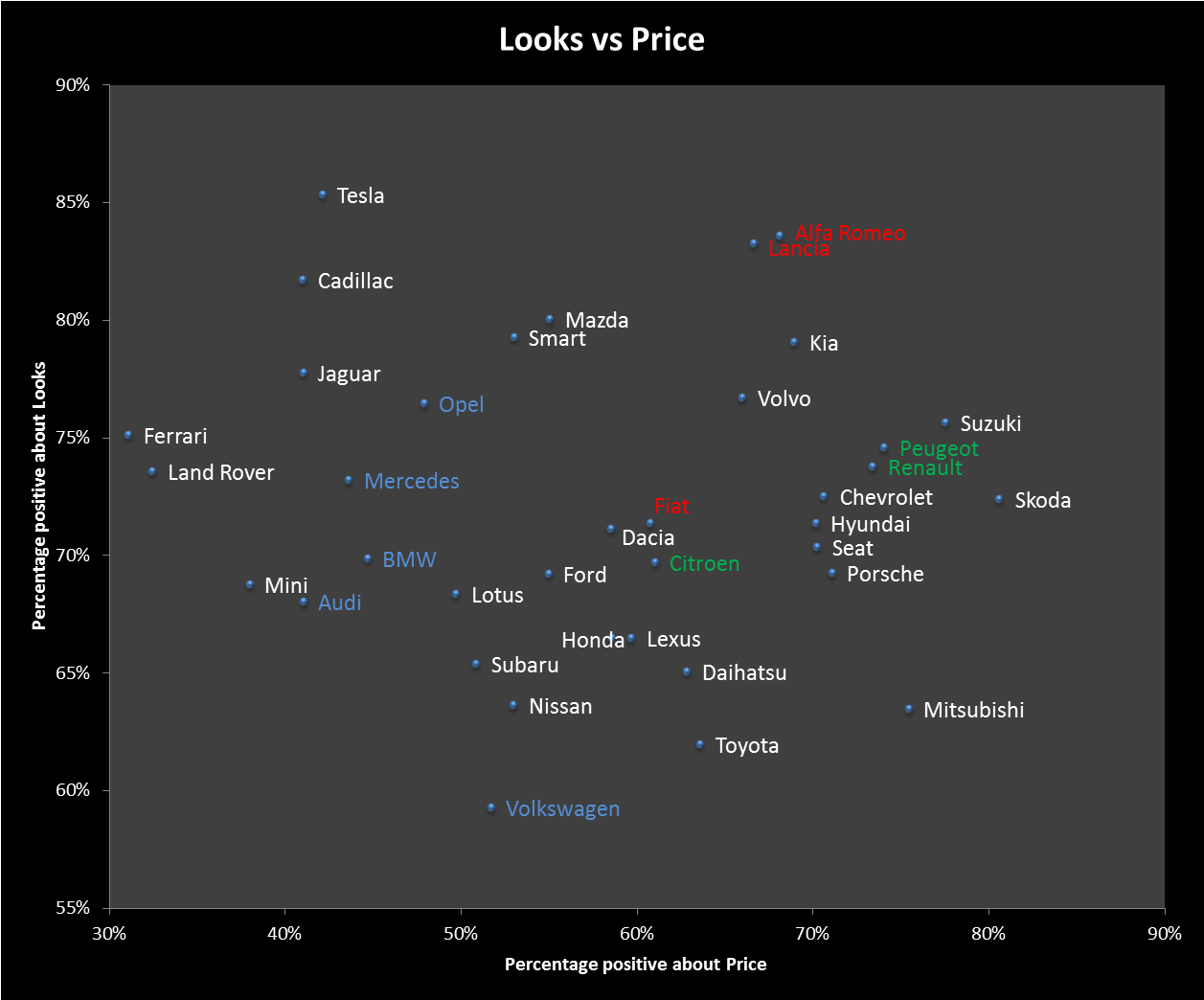

Another way of examining this data is to plot one factor against the other. For instance when using price on the horizontal axis and the looks on the vertical axis results in the graph below.

This graph clearly illustrates that for affordable good looking cast the Italian brands are in a league of their own. Fiat seems to be a bit out of contact with the other Italian brands, but still scores higher than most traditionally German brands.

The French brands are mostly associated with reasonably affordable and generally comfortable cars. This expectation can also be checked using our data since comfort was one of the main parameters included. The graph below plots the perceived comfort versus the price level of that brand.

The graph above illustrates that the Italian brands are perceived to offer less comfortable cars that the traditionally French brands. German brands score similarly but are generally in a higher price range. Surprisingly, Volkswagen scores higher than the luxury brands Mercedes and BMW. This may well result from the definition of Comfort used in this test, which included ergonomics, personal space and general practicality.

Conclusion

The conclusion that we draw from these results is that the data appears to be in agreement with most stereotypical preconceptions about the car brands. This is a good thing since the system is aimed at capturing the opinion of the general public, which by its nature can be expected to be sensitive to stereotyping.

A logical improvement in this study is to examine the various car models instead of the generic brands. In fact, the required data is available so if anyone is interested in these results or any other aspect of real time product sentiment monitoring, please don’t hesitate to contact us.

May 13, 2013

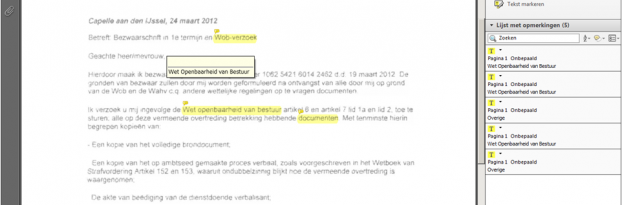

ViewerPro automatiseert verwerking Wet Openbaarheid van Bestuur (WOB) verzoeken

SemLab’s VIEWERPRO software wordt ingezet tegen het explosief stijgende aantal verzoeken van burgers, bedrijven en advocaten die beroep doen op de Wet openbaarheid van bestuur (WOB). “De reactietijd is thans zo verbeterd dat onze klanten, waaronder het Openbaar Ministerie, de stroom WOB verzoeken makkelijk aankunnen, en ruimschoots binnen de wettelijk gestelde termijn kunnen reageren” zegt Bram Stalknecht, SEMLAB te Alphen aan den Rijn. “Onze klanten vermoeden steeds vaker misbruik van deze wet, en hebben de stap genomen om onze taaltechnologie te gebruiken voor het detecteren van deze verzoeken. Door onze technologie in het informatieproces te integreren wordt de informatiestroom door een intelligent computersysteem gestuurd. Medewerkers worden nu ontlast en het systeem is zo ingeregeld dat het pieken makkelijk kan opvangen en flexibel voor elk WOB-onderwerp kan worden ingericht.”

Door middel van Natural Language Processing en Artificial Intelligence technieken detecteert VIEWERPRO met hoogste precisie en recall woorden en begrippen die relevant zijn uit de binnenkomende brieven en e-mails. Deze worden automatisch opgenomen in de reacties naar de verzoekers.

May 13, 2013

SemLab Internship Opportunities: Now open for international candidates

Internship Opportunities: Now open for international candidates:

1- Econometrics & Operations Research

2- Quantitative Modeling for Algorithmic Trading & Testing

We are looking for candidates for our fast growing work in our knowledge engineering developments in algorithmic trading.

Ad1-

Background of candidate is in Econometrics & Operations Research at a M.A. level university.

The candidate will be joining our Research & Development team in The Netherlands, near Amsterdam Airport. The thesis project is focusing on news analytics for multi asset class investments. The candidates should have an understanding of the implications and effects from news events on investments and risks. Macro economics and fixed income as well as equities and derivatives are subjects of interest of the internship work.

Duration: 6 month. After a successful completion of the thesis it is expected to be part of the growing development team.

Ad2-

Background of the candidate is in Quantitative Modeling and/or Financial Mathematics (M.Sc./PhD-thesis)

The candidate will be joining our Research & Development team in The Netherlands, near Amsterdam Airport. The thesis project is focusing on news analytics and market data for equity asset class algorithmic trading.

Candidates should have an understanding of risk/(multi) asset valuation modeling and an emphasis on financial service applications.

We require academic experience in the field of financial data analysis and research, with strong analytic solving skills, including tools like Matlab/R and experience of working with statistics and data sets for testing your algorithm and benchmark against indices.

Communication in English is essential to both of the intern positions as well as a valid EU working permit.

If you are interested in any of these positions please send your C.V. to stalknecht@semlab.nl

April 25, 2013

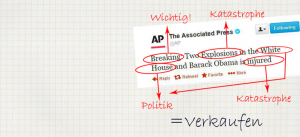

Filtering misinformation AP hacked twitter account; News analytics does work

Recently a hacker took over the twitter account for the Associated Press (AP), creating momentary chaos across the world. The hacker posted a fake message claiming that US President Barack Obama was injured as a result of an explosion in the White House: AP Twitter

Immediately after the fake tweet went live, legacy news feed machines took up this message. This resulted in drastic nosedives of both the Dow Jones Industrial Average and the S&P 500 before quickly rebounding: Machine in Control

“This is what happens if you don’t incorporated semantic cross referencing in your Machine Readable News (MRN) processing systems” says Bram Stalknecht, CEO of semantic analytics software vendor SemLab. “High frequency traders relying on social media only, without enhanced noise filtering and cross referencing, risk taking decisions based on wrong news”.

April 19, 2013

Reputation Brand Monitoring and Marketing

With Semlab’ proprietary semantic web software you can analyze millions of user forums, tumblr blogs, Twitter, Facebook and Google+ feeds, in order to measure in real-time the sentiment of your product and service opinions.

It has been a challenge imposed by processing social media because of use of incorrect language, irony, short or incomplete sentences, lack of contextual information, use of multiple languages and use of slang but Semlab succeeded to address all of these challenges with its semantic web solutions and other language processing technologies.

Semlab successfully can offer with the highest precision- and recall, of what the people think about your product and service.Don’t matter what language, slang they are using, you will capture the sentiment of the crowd immediately .User Case: Financial ServiceIn the domain of retail financial services, e.g. stock market investments, insurances, mortgages and consumer saving- & lending money, product- and service offering opinions will be processed real time.The combination of machine translation and automatic sentiment analysis has proven to be effective as semantic sentiment analysis appear to be relatively insensitive to grammatical translation errors. Especially in verbose and plentiful (highly redundant) social media messages even imperfect translations allow for reliable sentiment extraction. This was demonstrated in a precious project SemLab executed with the world most respected universities in this field where 81% translation accuracy was sufficient to drive adequate sentiment extraction from financial big data in social mediaThe resulting sentiment will be visualised in a GUI suitable for monitoring social media and to enable integration in social media outings.

The solution will be accessible through a web based service providing a clear visualization of the sentiment data and database.

The reputation brand monitoring and marketing solution is specially suitable for retail banks and insurance companies. These companies valued the content coming from the solution as consumer feed back of the findings of their financial products and how new financial product are received in the market.

This solution will address specifically the risk metric of financial service products from the eyes of consumers, the feed-back will allow the financial service companies to adjust the offerings accordingly and consequently improve reputation in the market.

A clear example of the current situation is the recent development on the Dutch mortgage market. The Dutch government has declared that the requirements for a mortgage are seriously increased. However to prevent total lock-up of the property market, the public is allowed to take a second loan. This second loan can be used to fulfil mortgage payments. Whereas this leads to opportunities for the mortgage suppliers, the general public is unable to assess the implications this can have for their overall cost. This is currently causing severe unrest in the Dutch mortgage market indicating the severely increased sensitivity of the financial services market for this – relatively transparent – measure.

Another example is the panic fuels Latvian run on Swedbank

http://www.bbc.co.uk/news/business-16142000

If you want to stay in control of the opinion: use our proprietary semantic web software.

April 15, 2013

Latest customers using our technology

SEMLAB’s technology is used across a wide range of industries to assist companies and government organizations to efficiently implement flexible solutions to the knowledge management- and data processing problems they face. Every day and night, our platforms are quietly at work assisting banks, hospitals, law enforcement, media agencies and regulators to process and maximize their intelligence and other core assets.

Some of our latest testimonials coming from organizations we work with, include:

EUROPEAN COMMISSION, Brussels, ICT,Competitiveness & Innovation, March 2013:

SEMLAB provides the most innovative solution in Language Technology in combination with high yield critical business processes, including financial services and risk management.

Nicolas Pratt, Machine Readable News-FOREX, April 2013:

As Machine Readable News gains further traction in FX, SEMLAB is extending its offerings.

The open platform from SEMLAB allows algorithmic traders from sell- and buy side to distinguish themselves when detecting news based information. Its natural language processing software combined with customizable event driven signals has become popular among the FX community, following the Equity Trading community.

According to Deutsche Boerse’s Market News International, Clint Rhea, COO,

In order to produce more tailored news feeds and signals, we entered into partnership with SEMLAB in order to disseminate more relevant content. Now we can tailor our events very quickly, adding value to our clients.

According to Bram Stalknecht, CEO SEMLAB, panelist at BATTLE OF THE QUANTS: Today’s algorithmic trading is not about macroeconomic market data nor sentiment signal from news providers. For the new generation algorithmic quant engineers, such as quants at WorldQuant, FirstNY, Graham Capital, Brevan Howard, Winton Capital, it’s more focused on creating proprietary decision models based on multiple sources, including news and social media.

Electronic execution is more commonplace accounting for over 60% of FX Trading while high frequency trading represents over 35% of FX trading volume, according to Aite Group statistics group.

This number will grow with SEMLAB offering complex event driven algo’s.

NASDAQ OMX, the US-based global exchange company, says Philip Adesso, Head of Analytics. There is a steadily growing interest in alpha generation within all asset classes. Mr. Adesso attributes the growth of machine readable news uptake to the evolution of FX algorithms which are now finally mirroring those in equity market. Algo’s based solely on pricing data are reaching a point where their value is exhausted. Dynamic algorithms that can act and react to market conditions like a human, need to consider many disparate prices of information. Machine readable news is arguably the most important piece, given that news precedes price, and machine readable news precedes scrolling news.

April 12, 2013

Irene Aldridge, speaker at NYU-Poly’s Big Data Finance Conference, May 3, NYC, Sponsor SEMLAB

Big Data is a fact, fueling a transformation of finance and the world of business in yet unpredictable ways. Scientific parsing of big data and Data Analytics are encountering challenges to process data, produce meaningful inferences and maintain the integrity and the safety of its use.

Irene Aldridge is Industry Assistant Professor, Dept. of Finance and Risk Engineering, Polytechnic Institute of New York University (NYU). At NYU, Aldridge specializes in cutting edge HFT and other data-driven finance research and teaches courses on HFT and algorithmic execution. Aldridge is the author of several books, including “High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems” (2nd edition just published by Wiley, 2013), translated into several languages.

Aldridge worked for various institutions on Wall Street and in Toronto, including Goldman Sachs and CIBC, and is a founder of ABLE Alpha Trading, LTD, a company specializing in high frequency trading technologies, including quantitative market-making. Her research has been profiled on BBC, CNBC, FOX Business, CBC, BNN, German ZDF, National Public Radio (NPR), Bloomberg Radio, as well as in the New York Times, the Wall Street Journal, Associated Press, Financial Times, Thomson/Reuters, Bloomberg LP, Forbes and other major business news outlets.

April 12, 2013

SemLab Sponsor of NYU-Poly’s Big Data Finance Conference, May 3, NYC

SEMLAB is sponsoring the Big Data Finance Workshop organized by the department of Finance and Risk Engineering of New York University, Polytechnic Institute on May 3, 2013, New York City

The target audience (invitation only) includes top academics in the field and practitioners in the high-frequency, quantitative and algorithmic industries, including customers like Goldman Sachs, ITG, QuantRisk Trading, Credit Suisse, JP MorganChase.

During the workshop SEMLAB will discuss advanced semantic analytics, specifically for quantitative- and algorithmic financial big data processing.

For more information: big data finance conference

Read more

Read more